Understanding Asset Tokenization

Asset tokenization is the process of transforming ownership rights of physical and digital assets into blockchain-based digital tokens. This method enables fractional ownership, simplifying the transfer, division, and trading of assets. Such a forward-thinking approach revolutionizes asset management and exchange within the digital economy.

Our Solutions

Unlock the Potential of Your Assets with Our Asset Tokenization Solutions

Our cutting-edge approach enables the conversion of tangible assets—like real estate and artwork—into digital tokens on the blockchain. Leverage our expertise in asset tokenization to embrace the future of finance.

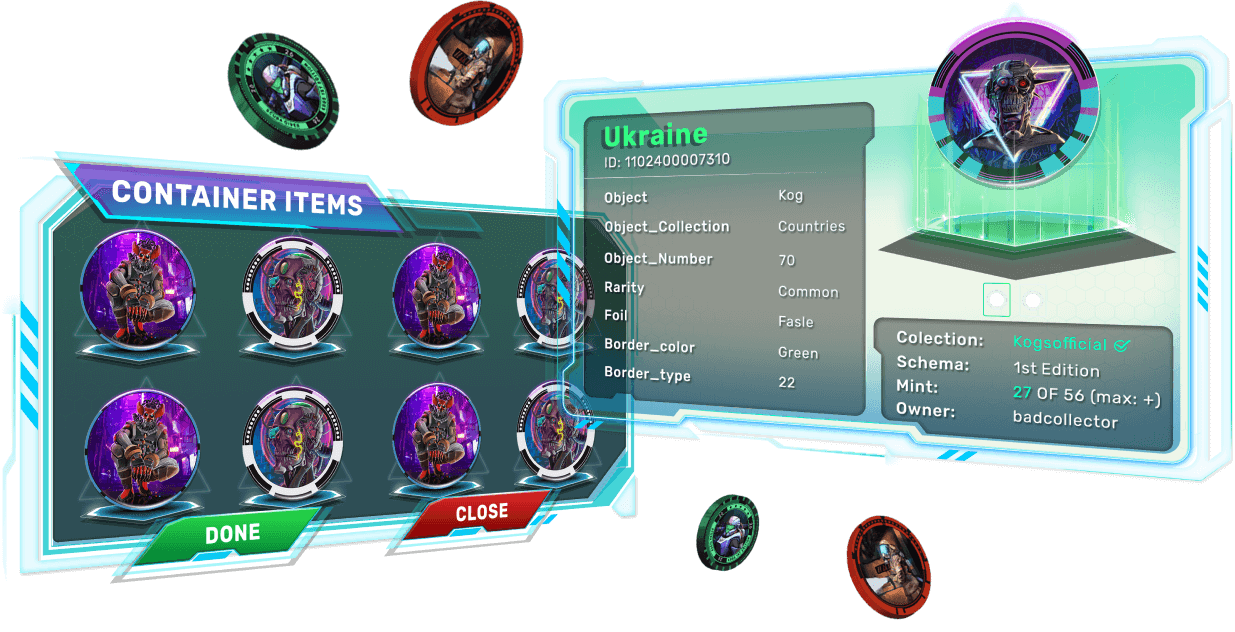

Collectibles (Unique Objects)

Transform unique items, such as fine art and luxury vehicles, into digital tokens, ensuring verified authenticity and clear ownership records.

Precious Metals

Tokenize assets like gold, silver, and platinum, providing investors with enhanced liquidity and the ability to own fractional shares.

Financial instruments

Revolutionize trading and investment in real estate, equities, and bonds through the power of tokenization.

Intangible Assets

Unlock value from patents, licenses, and trademarks, increasing their market accessibility.

Consumables

Improve transparency and efficiency in supply chains for goods like food and pharmaceuticals.

Agriculture

Create new trading opportunities for crop futures, land, and equipment, transforming the agricultural landscape.

Ranked Among the Top Web & App Development Companies

We Promise. We Deliver

Our Modules

Components of Our Asset Tokenization Ecosystem

Our asset tokenization ecosystem encompasses a comprehensive set of tools designed to simplify the tokenization process, ensure regulatory compliance, and enable efficient management and trading of tokenized assets.

Asset Offering Management Platform

A robust solution for offering managers to design and launch tokenized asset offerings, including real estate and artwork.

Compliance Management Platform

A dedicated tool for overseeing regulatory compliance throughout the tokenization journey, ensuring adherence to all relevant regulations.

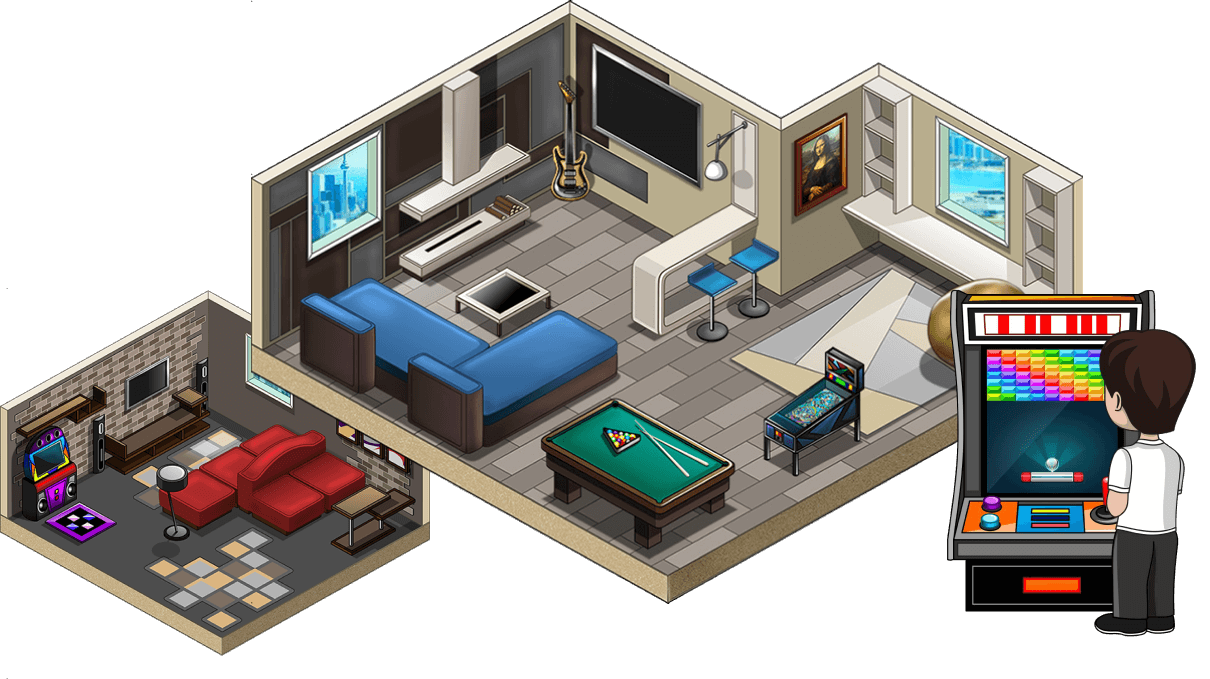

Tokenized Asset Marketplace

A specialized platform for trading tokenized assets, boosting liquidity and connecting users to a global network of investors.

Tokenization Facilitation Agent

A trusted intermediary that oversees the entire tokenization workflow, from verifying assets to issuing tokens.

Asset Transfer Facilitator

A service that guarantees secure and seamless transactions during the transfer of tokenized assets between parties.

Blockchain Validation Network

A consortium of validators responsible for verifying transactions on the blockchain, upholding the security and integrity of the ecosystem.

Client Benefits

Advantages of Asset Tokenization for Businesses

Asset tokenization revolutionizes the management and trading of assets in the digital era, delivering a range of significant benefits:

Access to Global Investors

Connect with a diverse array of investors across the globe, breaking down geographical barriers and attracting funding from international sources.

Reduced Costs

Optimize operations by lowering transaction fees and decreasing dependence on intermediaries, resulting in improved cost efficiency.

Opportunities for Fractional Ownership

Allow investors to purchase shares of high-value assets, making investments more attainable for a wider audience.

Increased Transparency

Leverage blockchain technology to maintain clear records of ownership and asset histories, building trust among all parties involved.

Democratized Access to Capital

Enable fundraising through token offerings, presenting alternative options to conventional capital-raising strategies.

Realization of Value

Transform previously illiquid assets into monetizable entities, enhancing their overall value and marketability.

Understanding Tokenized Securities

Tokenized securities are digital representations of ownership or interest in tangible assets, powered by blockchain technology. This modern approach combines traditional investment assets like stocks, bonds, real estate, and commodities with the advantages of blockchain, offering enhanced transparency, heightened security, and streamlined efficiency in asset management and trading.

Navigating the Tokenized Security Lifecycle

Lifecycle of a Tokenized Security

Understanding the lifecycle of tokenized securities is crucial for businesses and investors involved in asset tokenization. This process consists of several key stages:

Asset Selection & Evaluation

The journey begins by identifying the asset to be tokenized, assessing its market value, potential, and legal considerations.

Token Creation & Issuance

Assets are digitized on the blockchain using smart contracts, which embed compliance protocols and automate governance.

Legal Structuring & Compliance

Comprehensive legal frameworks are established to ensure compliance with securities regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Secondary Trading

Post-issuance, these securities can be traded on secondary platforms, providing enhanced liquidity for investors.

Asset Management & Servicing

Ongoing management ensures smooth operations, covering investor relations, compliance updates, and lifecycle servicing of the tokenized securities.

Primary Offering

The tokenized securities are launched, allowing investors to participate through private placements or public offerings.