Best DeFi Platforms in 2026: Top Decentralized Finance Apps to Use

By

Kamlesh Patyal

January 15, 2026

The rise of Decentralized Finance (DeFi) has transformed the financial landscape, offering a new way to access traditional financial services like lending, borrowing, trading, and insurance, but without intermediaries like banks or financial institutions. In 2026, the DeFi ecosystem continues to grow, with new platforms and applications emerging regularly. But how do you know which DeFi platforms are the best and most secure to use? In this comprehensive guide, we explore the best DeFi platforms of 2026, examine the technologies driving them, highlight their benefits and risks, and provide a list of the top decentralized finance apps for investors, traders, and developers. Whether you’re new to DeFi or a seasoned participant, this blog will help you navigate the evolving world of DeFi protocols.

What is DeFi?

DeFi refers to a financial ecosystem that operates on blockchain technology and allows for the provision of traditional financial services without relying on centralized intermediaries like banks or governments. Through smart contracts, decentralized protocols provide an alternative to conventional banking services, enabling users to borrow, lend, trade, and invest in digital assets securely and efficiently.

Key Characteristics of DeFi

Decentralized Finance (DeFi) has disrupted the traditional financial system by introducing a new era of peer-to-peer financial services powered by blockchain technology. Unlike traditional finance, DeFi operates without intermediaries, providing a transparent and open financial ecosystem.

- Decentralization: No central authority; instead, blockchain technology facilitates peer-to-peer transactions.

- Openness: Anyone can participate in DeFi services, without restrictions or geographical boundaries.

- Transparency: All transactions are recorded on public blockchains, ensuring accountability.

- Smart Contracts: Self-executing contracts where the terms are written into code, enabling automated processes.

- Interoperability: DeFi protocols work seamlessly across different blockchain networks, enhancing flexibility.

The main DeFi ecosystem trends in 2026 include greater interoperability, higher Total Value Locked (TVL), and the introduction of DeFi governance tokens that allow users to participate in decision-making within protocols.

🚀Request a free consultation with ChicMic Studios today!

How DeFi Works

DeFi platforms are built on blockchain technology and operate through smart contracts, enabling financial transactions without intermediaries. At the core of DeFi is the use of decentralized applications (dApps) that interact with blockchain networks to provide services like lending, borrowing, trading, and more.

Core Components of DeFi

DeFi platforms operate through a combination of blockchain technologies, smart contracts, and decentralized finance protocols. Here’s a closer look at how they work:

- Blockchain Technology: DeFi platforms leverage public blockchains (primarily Ethereum, Solana, and Binance Smart Chain) to execute transactions securely and transparently. These blockchains allow for the creation and storage of DeFi tokens, which represent various assets or liquidity.

- Smart Contracts: These self-executing contracts automate transactions between parties. For example, if someone borrows funds, the smart contract automatically executes the loan terms and returns the funds once repayment conditions are met.

- Liquidity Pools: These pools enable decentralized exchanges (DEXs) to function by aggregating liquidity for trades. Liquidity providers (LPs) deposit assets into these pools, and in return, they earn a portion of the transaction fees.

- Decentralized Exchanges (DEXs): These are platforms where users can trade cryptocurrencies directly without the need for an intermediary. Popular DEXs like Uniswap and SushiSwap allow for token swapping using smart contracts.

Benefits & Risks of DeFi Platforms

While DeFi platforms have gained immense popularity due to their innovative features and potential to revolutionize finance, they also come with their own set of benefits and risks. Understanding these advantages and challenges is crucial before diving into the decentralized finance world.

Benefits of DeFi

The DeFi ecosystem offers several benefits that traditional financial systems cannot match:

- Financial Inclusion: DeFi provides access to financial services for unbanked and underbanked populations globally.

- Transparency and Security: All transactions are recorded on public blockchains, ensuring transparency and reducing the potential for fraud.

- Efficiency: Smart contracts automate transactions, making DeFi platforms faster and cheaper than traditional financial systems.

- Greater Control: Users have full control over their funds, as they don’t need to trust a centralized third party.

Risks of DeFi

However, DeFi platforms come with their own set of risks:

- Smart Contract Vulnerabilities: While they are generally secure, flaws in smart contract code can lead to hacking or lost funds.

- Regulatory Uncertainty: The regulatory landscape for decentralized finance is still evolving, which can expose users and platforms to legal risks.

- Impermanent Loss: Liquidity providers may face impermanent loss when the value of tokens in a liquidity pool fluctuates, leading to potential losses.

- Market Volatility: Cryptocurrencies are notoriously volatile, which can result in significant price fluctuations for assets held in DeFi protocols.

🔗 Start your DeFi journey now!

Top DeFi Platforms in 2026

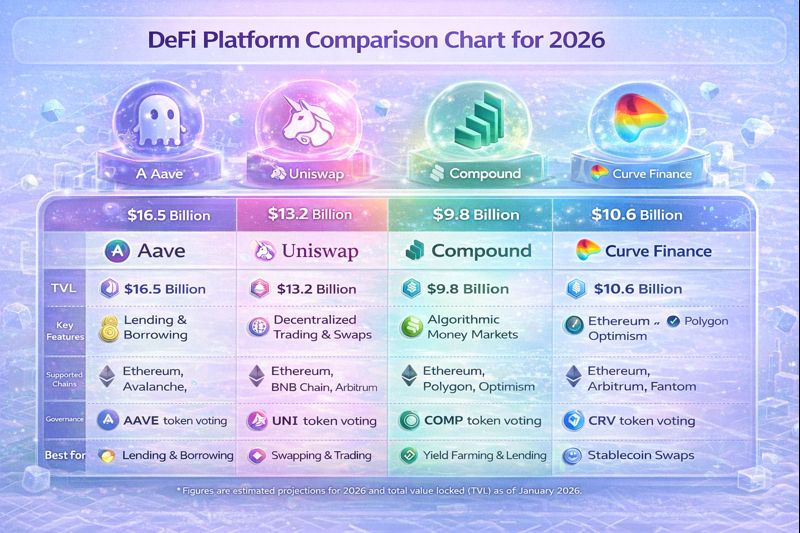

Here are some of the best and most widely used DeFi platforms in 2026 that are leading the way in terms of security, liquidity, and innovation:

1. Uniswap – The Leading DEX

Uniswap remains one of the most popular decentralized exchanges (DEX) that enables users to swap tokens on the Ethereum blockchain without relying on centralized authority. With over $10 billion in TVL, Uniswap has become a cornerstone in the DeFi ecosystem.

- Key Features:

- Easy-to-use interface

- High liquidity pools

- Automatic market-making (AMM)

- Governance via UNI token

2. Aave – Decentralized Lending and Borrowing

Aave allows users to lend and borrow crypto assets in a decentralized manner. With features like flash loans and over-collateralized lending, Aave has built a strong reputation in DeFi lending.

- Key Features:

- Wide range of supported assets

- Flash loans for instant borrowing

- Staking options for earning rewards

- Aave governance token (AAVE)

3. Compound – DeFi Lending Protocol

Compound is another top player in the DeFi lending space. It enables users to earn interest by lending crypto and to borrow assets at competitive rates. Compound has seen a rise in TVL and now offers integration with several blockchains.

- Key Features:

- Earning interest on crypto assets

- Borrowing against crypto collateral

- COMP token for governance

4. MakerDAO – Stablecoin and Lending

MakerDAO is one of the pioneers of the DeFi space, offering a decentralized platform for the issuance of the DAI stablecoin. DAI is pegged to the US dollar and can be used for lending, borrowing, and staking.

- Key Features:

- DAI stablecoin pegged to USD

- Multi-collateral vaults

- Governance via MKR token

5. Yearn Finance – DeFi Yield Aggregator

Yearn Finance aggregates yield farming strategies across multiple DeFi platforms to optimize returns for users. By automating the process of yield farming, Yearn has attracted a large community of DeFi investors.

- Key Features:

- Automated yield farming strategies

- Vaults for tokenized assets

- Community governance through YFI tokens

6. Synthetix – Derivatives and Synthetic Assets

Synthetix allows users to create and trade synthetic assets that represent real-world assets like stocks, commodities, and cryptocurrencies. This DeFi platform is growing rapidly as it allows users to gain exposure to a variety of markets without leaving the blockchain.

- Key Features:

- Trade synthetic assets

- High liquidity for derivative trading

- SNX token for collateral and governance

| Platform |

Services |

Key Features |

Fees |

TVL (2026) |

Supported Blockchains |

Governance Token |

| Uniswap |

Token swaps, liquidity provision, AMM |

Automated Market Maker (AMM), High liquidity, Governance via UNI |

0.3% per trade |

$10B+ |

Ethereum, Polygon |

UNI |

| Aave |

Lending, Borrowing, Staking |

Flash loans, Stable and variable interest rates, Multi-collateral support |

Variable fees |

$8B |

Ethereum, Polygon |

AAVE |

| Compound |

Lending, Borrowing |

Algorithmic interest rates, Supported token lending, Community governance |

Variable fees |

$6B |

Ethereum, Binance Smart Chain |

COMP |

| MakerDAO |

Lending, Stablecoins (DAI), Collateralized loans |

Multi-collateral vaults, DAI stablecoin issuance, Governance via MKR token |

Transaction fees (small) |

$5B |

Ethereum |

MKR |

| Yearn Finance |

Yield farming, Vault strategies, Staking |

Automated yield farming strategies, DeFi aggregator, Vaults for liquidity |

0.5% fee on yield farming |

$3B |

Ethereum, Binance Smart Chain |

YFI |

| Synthetix |

Derivatives, Synthetic assets |

Synthetic assets representing real-world assets, High liquidity, Trading of derivatives |

Trading fees |

$5B |

Ethereum, Optimism, Arbitrum |

SNX |

🌟 Get a personalized quote today!

How to Get Started with DeFi

Getting started with DeFi might seem daunting at first, but it’s simpler than it appears once you understand the steps involved. To begin participating in the DeFi ecosystem, you need a secure digital wallet, an understanding of the different DeFi protocols, and knowledge of blockchain platforms.

1. Choose the Right Platform

The first step in getting involved with DeFi is selecting the right platform based on your needs. Whether you’re looking to trade tokens, earn passive income through lending, or invest in synthetic assets, ensure the platform aligns with your goals.

2. Set Up a Digital Wallet

To participate in DeFi, you’ll need a digital wallet that supports decentralized applications (dApps). MetaMask, Trust Wallet, and Ledger are popular choices for interacting with DeFi platforms.

3. Connect Your Wallet and Start Participating

Once your wallet is set up, connect it to your chosen DeFi platform and start trading, lending, or earning. Make sure you understand the risks involved and the steps to protect your funds.

FAQ: Best DeFi Platforms in 2026

Q1: What are the best DeFi platforms in 2026?

The best DeFi platforms in 2026 include Uniswap, Aave, Compound, MakerDAO, Yearn Finance, and Synthetix. These platforms offer a wide range of decentralized financial services like lending, borrowing, trading, and liquidity provision. They are trusted by users for their security, scalability, and user experience. As the DeFi ecosystem continues to expand, these platforms have established themselves as leaders in the space, each specializing in different areas to meet diverse financial needs.

Q2: How do DeFi platforms work?

DeFi platforms use blockchain technology and smart contracts to provide decentralized financial services. These platforms remove intermediaries like banks, allowing users to interact directly with one another through secure, automated processes. For example, DeFi lending platforms like Aave allow users to lend or borrow assets by interacting with smart contracts that execute transactions based on predefined conditions. By operating on a decentralized network, DeFi platforms ensure transparency, security, and control over assets for their users.

Q3: What are the risks of using DeFi platforms?

While DeFi platforms offer many advantages, they also come with risks. Smart contract vulnerabilities can lead to exploits if the code is not secure. Market volatility is another risk, especially when dealing with cryptocurrencies, which can fluctuate dramatically in short periods. Regulatory uncertainty also poses a challenge, as many jurisdictions are still figuring out how to regulate DeFi platforms. Finally, impermanent loss can occur for liquidity providers when the price of tokens in liquidity pools fluctuates, leading to potential losses in value compared to simply holding the assets.

Q4: How does DeFi governance work?

DeFi governance allows users to have a say in the development and decision-making processes of decentralized platforms. Governance tokens, like COMP for Compound or AAVE for Aave, are distributed to users who participate in the ecosystem. Token holders can propose changes, vote on governance proposals, and influence the platform’s evolution. This decentralized decision-making process ensures that the community has control over the future direction of the platform, making it more democratic and aligned with users’ interests.

Q5: How can I get started with DeFi?

To get started with DeFi, you’ll need a digital wallet compatible with DeFi platforms, such as MetaMask or Trust Wallet. Once you’ve set up your wallet, you can fund it with cryptocurrency from a centralized exchange like Coinbase or Binance. After funding your wallet, you can connect it to DeFi apps and start participating in activities like yield farming, lending, or staking. Be sure to research the DeFi platforms you want to use to understand their features, fees, and risks before making any investments.

Concluding Note

DeFi is poised for even greater growth in 2026, with platforms and protocols offering users more control, transparency, and financial inclusion than ever before. Whether you’re interested in DeFi lending, yield farming, or synthetic assets, there’s a platform that fits your needs. As the space continues to evolve, it’s crucial to stay informed about the latest developments and select the right platforms that align with your investment strategy. At ChicMic Studios, we specialize in DeFi development and can help your business tap into the potential of blockchain technology. We offer solutions for DeFi app development, smart contract development, and blockchain integration.